lubertsi-beeline.ru

Prices

Credit Card Promotions 0 Interest

Save interest on big purchases with a 0% intro APR. Get zero interest for up to 15 months or more. Compare 0% intro APR cards of and apply. Many credit cards offer promotional 0% rates on balance transfers. Promotional periods vary from 6 to 21 months, depending on the offer. 0% Intro APR Credit Cards ; Slate Edge credit card · Save on interest with a low intro APR for 18 months ; Chase Freedom Unlimited credit card · Earn a $ bonus. Terms and conditions are applied to gift cards. APY = Annual Percentage Yield, APR = Annual Percentage Rate; +Rates are based on an evaluation of credit history. APR fixed for the life of the loan. No down payment. Not valid in Puerto Rico, USVI, and Guam. NMLS # Pro Xtra Credit Card. Our partners' introductory 0% APR credit cards promotional periods last for 6–18 months. After the intro APR period is over, the interest rate on the. Wells Fargo Reflect® Card: Best for Longest 0% intro period · BankAmericard® credit card: Best for Long intro period + straightforward benefits · U.S. Bank Visa®. 0% intro APR credit cards: 0% intro APR on purchases for months. Then % - % Standard Variable Purchase APR applies. Offers vary based on card. With promotional 0% APR periods, some cards let you avoid interest payments on purchases, balance transfers or both. Save interest on big purchases with a 0% intro APR. Get zero interest for up to 15 months or more. Compare 0% intro APR cards of and apply. Many credit cards offer promotional 0% rates on balance transfers. Promotional periods vary from 6 to 21 months, depending on the offer. 0% Intro APR Credit Cards ; Slate Edge credit card · Save on interest with a low intro APR for 18 months ; Chase Freedom Unlimited credit card · Earn a $ bonus. Terms and conditions are applied to gift cards. APY = Annual Percentage Yield, APR = Annual Percentage Rate; +Rates are based on an evaluation of credit history. APR fixed for the life of the loan. No down payment. Not valid in Puerto Rico, USVI, and Guam. NMLS # Pro Xtra Credit Card. Our partners' introductory 0% APR credit cards promotional periods last for 6–18 months. After the intro APR period is over, the interest rate on the. Wells Fargo Reflect® Card: Best for Longest 0% intro period · BankAmericard® credit card: Best for Long intro period + straightforward benefits · U.S. Bank Visa®. 0% intro APR credit cards: 0% intro APR on purchases for months. Then % - % Standard Variable Purchase APR applies. Offers vary based on card. With promotional 0% APR periods, some cards let you avoid interest payments on purchases, balance transfers or both.

8 best 0% APR and low-interest credit cards of September · Browse by card categories · Capital One VentureOne Rewards Credit Card · Blue Cash Preferred® Card. Pros of 0% APR credit cards · Avoid interest during the promotional period · Credit score improvement · Reduce debt faster · Other rewards and benefits. A 0% APR credit card comes with a promotional period during which you pay no interest on eligible new purchases. MoneyGeek used a proprietary ranking algorithm. These cards provide you with a 0% intro APR for a set period of time. Often this low intro APR can last for 12 months, but some credit card offers might. American Express helps you save with 0% intro APR Credit Cards offers. Compare our cards and different benefits to find the one that works for you best. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. Apply for a CommunityAmerica credit card and pay no interest for 18 months, earn great rewards and enjoy no annual fee. Apply Today! Save more on interest fees with our zero percent APR credit cards. Explore Mastercard credit cards to find the right card for your lifestyle needs. Why this is one of the best 0% introductory APR credit cards: The Wells Fargo Reflect card comes with a 0% intro APR for 21 months from account opening. After. 0% Intro APR Credit Cards ; Citi Simplicity® Credit Card · Low intro APRon purchases for 12 months. 0 · on balance transfers for 21 months ; Citi® Diamond Preferred. The The Blue Business® Plus Credit Card from American Express offers new users an intro APR of 0% on purchases for 12 months from date of account opening ( A 0% APR credit card offers no interest for a period of time, typically six to 21 months. During the introductory no interest period, you won't incur interest. Explore low intro rate credit cards ; 0% intro APR for 15 months; % - % variable APR after that, 0% intro APR for 15 months; % - % variable. Unlock the features of your new TD credit card including late fee forgiveness and no annual fees If you have a 0% introductory or promotional APR balance. Detailed Reviews of 0% APR Credit Cards · Citi Diamond Preferred Card Review · Citi Diamond Preferred Card Review · Capital One VentureOne Rewards Credit Card. 14 partner offers ; Wells Fargo Reflect Card · 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers · %, %, or. Our partners' introductory 0% APR credit cards promotional periods last for 6–18 months. After the intro APR period is over, the interest rate on the.

What Are The Best Certificate Of Deposit Rates

The best rate we've found is % APY from California Coast Credit Union Celebration Certificate. However, the credit union has a small footprint for eligible. Standard CDs · 6 Months, %, %. 12 Months, %, %. 18 Months, %, %. 24 Months, %, %. 36 Months, %, % ; Bump Rate CDs · The best CD rate is % on a six-month CommunityWide Federal Credit Union CW Certificate Account, though you can find competitive yields on other terms too. Personal Deposit Interest Rates ; 6 Month, %, % ; 7 Month Promo · %, % ; 9 Month, %, % ; 11 Month Promo · %, %. Discover competitive CD rates at TowneBank. Invest in your future with our secure certificate of deposit options. Grow your savings reliably. TAB Bank offers a great 1-year business CD, with a % APY. The $1, minimum deposit requirement is not great, but its interest rate is the highest around. With CD terms ranging from just a few months to multiple years, there are options to fit both your short- and long-term needs. Explore our CD rates today. High-Growth Certificates of Deposit ; CDs · Rates Effective 09/15/ ; Term, Tier, Annual Percentage Yield (APY) ; 6 months, $ - $49,, % ; $50, -. For Featured CD Account · % ; For Standard Term CD Account · % ; For Flexible CD Account · %. The best rate we've found is % APY from California Coast Credit Union Celebration Certificate. However, the credit union has a small footprint for eligible. Standard CDs · 6 Months, %, %. 12 Months, %, %. 18 Months, %, %. 24 Months, %, %. 36 Months, %, % ; Bump Rate CDs · The best CD rate is % on a six-month CommunityWide Federal Credit Union CW Certificate Account, though you can find competitive yields on other terms too. Personal Deposit Interest Rates ; 6 Month, %, % ; 7 Month Promo · %, % ; 9 Month, %, % ; 11 Month Promo · %, %. Discover competitive CD rates at TowneBank. Invest in your future with our secure certificate of deposit options. Grow your savings reliably. TAB Bank offers a great 1-year business CD, with a % APY. The $1, minimum deposit requirement is not great, but its interest rate is the highest around. With CD terms ranging from just a few months to multiple years, there are options to fit both your short- and long-term needs. Explore our CD rates today. High-Growth Certificates of Deposit ; CDs · Rates Effective 09/15/ ; Term, Tier, Annual Percentage Yield (APY) ; 6 months, $ - $49,, % ; $50, -. For Featured CD Account · % ; For Standard Term CD Account · % ; For Flexible CD Account · %.

Today's CD Special Rates ; 4 month · % · % ; 7 month · % · % ; 11 month · % · %. View CD Rates of over banks and credit unions so you can be sure to get the best rates on the market! Southern Bank's best CDs feature rates up to % APY. Learn more about our CD rates or try our interest-earning calculator on our website today! 60 MONTHS Quontic's CDs shine with top rates across terms from six months to five years, and the opening minimum of $ is relatively low compared to other. CD Rates Today: September 13, —Earn Up To % As of today, the best interest rates on CDs—certificates of deposit—pay up to %, based on certificate. Apply for a Popular Direct CD today. ; 3 Months, %, % ; 6 Months, %, % ; 12 Months, %, % ; 18 Months, %, %. Saving for Good. Intrafi Network Deposits CDARS® (Certificates of Deposit Account Registry Service) is available at the same rates as Certificates of Deposit. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. Discover competitive CD rates at TowneBank. Invest in your future with our secure certificate of deposit options. Grow your savings reliably. With an affordable minimum balance and a fixed interest rate that earns you higher dividends than an average savings accounts, it's an ideal choice. Best 1-Year CD Rates · Mountain America Credit Union – % APY · Merchants Bank of Indiana – % APY · National Cooperative Bank — % APY · Abound Credit. The highest CD rate we've found for September is from Newtek Bank, which currently pays out a % variable annual percentage yield (APY) on 2-year CDs. Certificates of Deposit, also known as CDs, are a smart, safe choice for saving money for the future. By putting aside money for a set period of time. More for your money. CDs offer our most competitive, promotional rates - and great returns. · Guaranteed returns. Choose the term length that works best for you. Check out the latest CD rates offered by Ally Bank. Features include daily compounding interest and 10 day best rate guarantee. Ally Bank, Member FDIC. Summary of the highest CD rates ; Sallie Mae certificates of deposit · %, % ; My eBanc Online Time Deposit · %, % ; Bread Savings certificates of. Standard CDs · 6 Months, %, %. 12 Months, %, %. 18 Months, %, %. 24 Months, %, %. 36 Months, %, % ; Bump Rate CDs · Choose a certificate of deposit from North American Savings Bank in metro Kansas City, MO and enjoy competitive CD rates to help you save for the future. We shop the top banks and lenders to bring you the best guaranteed investment certificate Highest GIC interest rates (non-redeemable). Best 1 year GIC: %. Personal Deposit Interest Rates ; 6 Month, %, % ; 7 Month Promo · %, % ; 9 Month, %, % ; 11 Month Promo · %, %.

Starting Stocks With $100

Invest in real estate · Gather your savings in a high-yield savings account · Invest in the stock market · Start a blog · Use robo advisors · Invest in. Everybody has to start somewhere. So you might as well start today. Today, you can invest in stocks with just $ I started investing in the stock market. In good times, the value of your shares increases. For example, suppose you start buying shares in a stock fund that costs $20 per share. You decide you will. Annual Returns on Investments in, Value of $ invested at start of in, Annual Risk Premium, Annual Real Returns. Year, S&P (includes dividends), 3. Stocks: Individual stocks are shares of a company that can increase in value Your principal, or starting balance, is your jumping-off point for the purposes. Make every dollar count with just $ Invest in your future by From mutual funds and ETFs to stocks and bonds, find all the investments you. When people ask Warren Buffett what advice he has for new investors to get started investing, he doesn't say buy my stock, which he could as it's a great. Make every dollar count with just $ Invest in your future by enrolling in investing in stocks.**. Read more about navigating in a down market. I would advise the Schwab S&P fund SWPPX or the total stock market fund SWTSX -- both have minimum investments of $ and cost you just Invest in real estate · Gather your savings in a high-yield savings account · Invest in the stock market · Start a blog · Use robo advisors · Invest in. Everybody has to start somewhere. So you might as well start today. Today, you can invest in stocks with just $ I started investing in the stock market. In good times, the value of your shares increases. For example, suppose you start buying shares in a stock fund that costs $20 per share. You decide you will. Annual Returns on Investments in, Value of $ invested at start of in, Annual Risk Premium, Annual Real Returns. Year, S&P (includes dividends), 3. Stocks: Individual stocks are shares of a company that can increase in value Your principal, or starting balance, is your jumping-off point for the purposes. Make every dollar count with just $ Invest in your future by From mutual funds and ETFs to stocks and bonds, find all the investments you. When people ask Warren Buffett what advice he has for new investors to get started investing, he doesn't say buy my stock, which he could as it's a great. Make every dollar count with just $ Invest in your future by enrolling in investing in stocks.**. Read more about navigating in a down market. I would advise the Schwab S&P fund SWPPX or the total stock market fund SWTSX -- both have minimum investments of $ and cost you just

There are no guarantees of profits, or even that you will get your original investment back, but you might make money in two ways. First, the price of the stock. $ per month from ages White box with blue text $K Blue box with Actionable investing ideas; Unlimited free online stock, ETF, & options trades. Compounding means that you earn money on your original investment — and on the profits you've already made from your investments. If you invest $ at 10%. Definitions. Starting amount: The amount invested at the start Earnings from stocks and mutual funds that invest in stocks are often compounded annually. But keep in mind that $ is such a small amount for stocks. A good amount to start with is $ But if $ is all you can afford right now. But I didn't start out as a low-risk investor. Far from it, actually! In fact, the way I started my journey Was by losing a tonne of money in the stock market. Stocks, bonds, mutual funds, ETFs and more. Risk: You can potentially $ over 20 years with a 7% return rate. Note that an investment return of. Open and fund your account and get $ from Schwab to split equally across the top five stocks in the S&P , plus education and tools to help you take the. In contrast, the potential gain for a short is limited to the initial amount shorted. For example, if you short shares of ABC at $ per share, the most. If you start now, your investment of S$ per month for 30 years at companies listed on the Singapore stock exchange. Do note that past. The $ put into a savings account will earn a very low interest rate, and over time, it will likely lose value to inflation. Do you think that you can't start investing because you don't have thousands of dollars in your bank account to spend right now? Think again. Every company. Stocks are shares in the ownership of a company. You can invest in an ETF for less than $, while mutual funds often ask you to invest at least $1, Investing in stocks, bonds and mutual funds offers the potential to grow $ a month beginning in 10 years and continues for the next four decades. Since most years the stock market goes up, that means you'll be earning interest on a higher balance. In the table below you can see that if you start with $ Mutual funds or ETFs—Mutual funds and ETFs pool together money from many investors to purchase a collection of stocks, bonds, or other securities. You can use. Stocks, options, exchange-traded funds and over 10, mutual funds · Standard trade fee of $ with no minimum investment · Phone support when you need it · We're about to show you how Beanstox makes it possible for you to invest in the stock market, even if you're starting with just $! If buying individual stocks seems too confusing or risky – and you'd rather just let your money grow without your involvement, then start investing with. You can invest $ by opening an investing account that does not require a minimum account balance and purchasing shares of a stock or ETF that are less than.

30 Year Refi Mortgage Rates Today

The NAHB saw year fixed rates rising to % in , when they anticipated ARMs to jump from estimates of % to %. Mortgage rate caps What is a year fixed-rate mortgage? A year fixed rate mortgage is a home loan structure that establishes an unchanging interest rate. Weekly national mortgage interest rate trends ; 30 year fixed refinance, % ; 15 year fixed refinance, % ; 10 year fixed refinance, % ; 5/1 ARM refinance. The current average year fixed mortgage rate fell 5 basis points from % to % on Monday, Zillow announced. The year fixed mortgage rate on August. A lower interest rate will save you on short- and long-term interest while reducing your monthly payments. For example, a $,, year fixed-rate mortgage. Browse today's current mortgage interest rates for refinance. Refinance rates This could mean moving from a year to a year mortgage, for example. BMO Prime Mortgage Rate is %. Special Rates. Bring out the calculator. Find some help estimating your mortgage payments, how much you can afford and more. year Fixed Mortgage Rate Predictions The NAHB saw year fixed rates rising to % in , when they anticipated ARMs to jump from estimates. 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. The NAHB saw year fixed rates rising to % in , when they anticipated ARMs to jump from estimates of % to %. Mortgage rate caps What is a year fixed-rate mortgage? A year fixed rate mortgage is a home loan structure that establishes an unchanging interest rate. Weekly national mortgage interest rate trends ; 30 year fixed refinance, % ; 15 year fixed refinance, % ; 10 year fixed refinance, % ; 5/1 ARM refinance. The current average year fixed mortgage rate fell 5 basis points from % to % on Monday, Zillow announced. The year fixed mortgage rate on August. A lower interest rate will save you on short- and long-term interest while reducing your monthly payments. For example, a $,, year fixed-rate mortgage. Browse today's current mortgage interest rates for refinance. Refinance rates This could mean moving from a year to a year mortgage, for example. BMO Prime Mortgage Rate is %. Special Rates. Bring out the calculator. Find some help estimating your mortgage payments, how much you can afford and more. year Fixed Mortgage Rate Predictions The NAHB saw year fixed rates rising to % in , when they anticipated ARMs to jump from estimates. 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %.

A year fixed rate mortgage is the most common mortgage loan option. It has a repayment period of 30 years. The interest rate on a year fixed mortgage does. Mortgage rates today ; yr fixed · % · % · ($3,) ; yr fixed FHA · % · % · ($3,) ; yr fixed · % · % · ($3,). year mortgage rates currently average % for purchase loans and % for refinance loans. · Mortgage Purchase rates in Charlotte, NC · Current year. Personalize your rate ; 15 Year Fixed. $3, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. Average mortgage rates today: year mortgage: %; year mortgage: %. Average refinance rates today: year refinance: %; year refinance: Fannie Mae and the Mortgage Bankers Association forecast the average year fixed rate mortgage to fall below the % mark in the fourth quarter and continue. Today's Mortgage Refinance Rates. Rates aren't one size fits all. The best Learn About Year Fixed Loans. Year Fixed. Rate%. /. APR%. Points. (). What. Current Mortgage and Refinance Rates. Customized purchase rates. A mortgage Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year. year fixed mortgage rates for August 28, ; year fixed VA ; year fixed VA, %, %. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, Today's year fixed refinance rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Fannie Mae: Rates will average % in Q3 and % in Q4. Fannie Mae expects the average year fixed mortgage rate to trend slightly down between for Q3 and. 30 Year Fixed Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · Check today's mortgage rates for buying or refinancing a home. Connect Learn About Year Fixed Loans. Year Fixed. Rate%. /. APR%. Points. (). What. Average Mortgage Rates, Daily ; 30 Year Refinance. %. % ; 15 Year Refinance. %. % ; 5 Year ARM. %. % ; 3 Year ARM. %. %. Personalize your rate ; 15 Year Fixed. $3, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. Current year refinance rate trends. Average year refinance rates are near a year high at %, as of April 13, Mortgage rates tend to. Introduction to Year Fixed Mortgages ; 30 Year Fixed Average, %, % ; Conforming, %, % ; FHA, %, % ; Jumbo, %, %. Today's competitive refinance rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · A fixed-rate loan of $, for 30 years at % interest and % APR will have a monthly payment of $1, Taxes and insurance not included; therefore.

Open A Brokerage Account Online

Open a Brokerage account online in about 10 minutes. · Choose an account type · Fund your account · Start trading · Manage your account with ease. Get closer to your financial goals with a Firstrade general investing brokerage account. Learn about the different account types and features available. How To Open an Online Brokerage Account · Step 1: Decide How You Will Use Your Brokerage Account · Step 2: Evaluate How the Brokerage Can Help You Reduce Risk. PNC Investments Brokerage Accounts · Trade Online or Work with a Professional: Account Options to Fit Your Needs · Why a Brokerage Account? · Related Resources. Low-Cost Investing With No Minimums. Pay no trade minimums, no account minimums and $0 online listed equity trades. · Tools and Research. Make confident. Which Brokerage Accounts Let Me Trade for Free? Since Robinhood opened the doors to commission-free trading, dozens of online brokerage platforms have. Trade stocks, ETFs, options, no-load mutual funds, money markets, and more. Simple, transparent pricing. $0 minimum to open account. $0 per online stock and ETF. The best online stock brokers for beginners: · Charles Schwab · Fidelity Investments · Interactive Brokers · Ally Invest · E-Trade Financial · Firstrade · Firstrade. An online brokerage account allows you to easily transfer available funds between your Bank of America bank and Merrill investment accounts. Open a Brokerage account online in about 10 minutes. · Choose an account type · Fund your account · Start trading · Manage your account with ease. Get closer to your financial goals with a Firstrade general investing brokerage account. Learn about the different account types and features available. How To Open an Online Brokerage Account · Step 1: Decide How You Will Use Your Brokerage Account · Step 2: Evaluate How the Brokerage Can Help You Reduce Risk. PNC Investments Brokerage Accounts · Trade Online or Work with a Professional: Account Options to Fit Your Needs · Why a Brokerage Account? · Related Resources. Low-Cost Investing With No Minimums. Pay no trade minimums, no account minimums and $0 online listed equity trades. · Tools and Research. Make confident. Which Brokerage Accounts Let Me Trade for Free? Since Robinhood opened the doors to commission-free trading, dozens of online brokerage platforms have. Trade stocks, ETFs, options, no-load mutual funds, money markets, and more. Simple, transparent pricing. $0 minimum to open account. $0 per online stock and ETF. The best online stock brokers for beginners: · Charles Schwab · Fidelity Investments · Interactive Brokers · Ally Invest · E-Trade Financial · Firstrade · Firstrade. An online brokerage account allows you to easily transfer available funds between your Bank of America bank and Merrill investment accounts.

How to open a brokerage account · 1. Decide whether you want to trade or invest · 2. Understand the charges and risks · 3. Fill in an application form · 4. Get. Steps to open an account · 1. Choose the type of investment account you want · 2. Compare fees, pricing schedules, and minimum balance requirements · 3. Review. If you're going with the more traditional route, you'll have to set up a meeting at the brokerage to open an account. If you're going the online route, it's. Many firms let you open an account online by completing a simple application. Be prepared to provide personal information, such as your address, Social Security. Learn about the features and benefits of the Fidelity Brokerage Account, a low-cost account that can meet your needs as an investor. Get free online trades a year and then just $ for stock and ETF trades after that with no minimums to open an account. Find out more. Want help managing. A brokerage account is a non-retirement investment account that lets you buy and sell securities like stocks, bonds, mutual funds and ETFs. You can deposit as. A brokerage account is an account you can use to invest money to buy investments like stocks, bonds and mutual funds. Compare your options and open a. Open an online brokerage account. ; Your portfolio, your way. Opening an investment account online is simple, secure and only takes minutes. Open now for a Merrill individual brokerage account. Prefer to have this. Open a Schwab account online today to start saving, trading or investing. We offer brokerage, IRA, checking and Schwab Intelligent Portfolios online. A brokerage account is a standard nonretirement investing account. You can hold mutual funds, ETFs (exchange-traded funds), stocks, bonds, and more. investment management services. Learn more. Brokerage account. Trade smarter with $0 commissions1 for online US stock, ETF, and option trades; fractional. Many firms let you open an account online by completing a simple application. Be prepared to provide personal information, such as your address, Social Security. Brokerage accounts allow investors to buy and sell numerous types of investments. When opening a brokerage account, investors have two main options: a cash. Conveniently invest in stocks, ETFs and mutual funds with brokerage fees starting at $0. Already have a J.P. Morgan account? Keep an eye on your investments and. There is no minimum to open a Self-Directed brokerage account. However, accounts that remain unfunded for more than 30 days or have a balance below $ for a. Once you've decided on a brokerage firm, the online application process can take less than 15 minutes to complete. You will need identifying information. Opening a new account online can take around 15 minutes. Typically, you'll fill out an online form providing information on your employment, net worth. All brokerage trades settle through your Vanguard settlement fund. · Before you invest: Start by learning the basics · Decide what investments suit your goals and.

Sellers Agent Real Estate

Interview a few agents – RECO recommends at least three – and make sure you fully understand their experience, how they operate, and what services they offer. When the agent represents the seller of real estate, they are known as the listing agent (seller agency) of the property. This agent represents the best. Your offer in writing needs a counter in writing from the sellers. Your realtor working against you without paperwork is really bad optics. Full disclosure is always recommended in real estate. This goes for buyers and sellers, as well as real estate agents. Another reason it can be risky to use the. Selling agents work with buyers to identify properties that fit their criteria, arrange property showings, and negotiate offers on their behalf. They are also. Most real estate agents who show and market houses are seller's agents. They may be friendly to you as a potential buyer, show you multiple listings and help. real estate salesperson who is not affiliated with or acting as the listing real estate broker for a property, is not a buyer's agent, has a brokerage. The agent may represent either the buyer or the seller. A real estate broker does the same job as an agent but is licensed to work independently and may employ. Listing Agents: This is the agent that represents the seller of the property. They help you price, market, and sell your current home. · Selling / Buyer's Agents. Interview a few agents – RECO recommends at least three – and make sure you fully understand their experience, how they operate, and what services they offer. When the agent represents the seller of real estate, they are known as the listing agent (seller agency) of the property. This agent represents the best. Your offer in writing needs a counter in writing from the sellers. Your realtor working against you without paperwork is really bad optics. Full disclosure is always recommended in real estate. This goes for buyers and sellers, as well as real estate agents. Another reason it can be risky to use the. Selling agents work with buyers to identify properties that fit their criteria, arrange property showings, and negotiate offers on their behalf. They are also. Most real estate agents who show and market houses are seller's agents. They may be friendly to you as a potential buyer, show you multiple listings and help. real estate salesperson who is not affiliated with or acting as the listing real estate broker for a property, is not a buyer's agent, has a brokerage. The agent may represent either the buyer or the seller. A real estate broker does the same job as an agent but is licensed to work independently and may employ. Listing Agents: This is the agent that represents the seller of the property. They help you price, market, and sell your current home. · Selling / Buyer's Agents.

Usually, real estate commissions are paid by the Seller and are split between the agent who represents the Seller (the 'listing agent') and the agent who. As the seller's agent, it will be your job to help your client remove any excess furniture and clutter from the home. This will help the rooms feel larger and. Buyer's agents are licensed real estate professionals who are responsible for searching, evaluating and negotiating the purchase of a property on a buyer's. Keep in mind that in this case, the listing agent works for the seller, so their loyalties and duties are to the seller only. As such, the listing agent should. Sometimes the seller's agent (also known as the listing agent) can also represent the buyer, but this is rare (and illegal in some states). If you have asked. Taking Alberta as one example, the typical commission charged by a listing real estate agent is 7% on the first $K and 3% on the remainder. Does a Real Estate Agent Get a Commission When Buying or Selling Their Own Property? Real estate is a commission-based industry. Agents typically don't earn a. r/RealEstate icon. r/RealEstate · What is the etiquette regarding commission when switching real estate agents? 3 upvotes · 14 comments. r. Most real estate agents are paid through commissions. · A single commission is usually split four ways—between the agent and the broker for the seller and the. This is why Wisconsin law requires real estate agents to treat all parties honestly and fairly in a real estate transaction. The law also provides that the. When a real estate professional works on behalf of only one client in a transaction—the buyer or the seller—they have legal responsibilities, which include. A selling agent, also known as a buyer's agent, is the agent who represents the buyer in a real estate transaction. Their primary responsibility is to help the. Some listing agents will indeed give the seller a break on their commission if there is no buyer's agent, but that's not automatic, says Ken Pozek, a Realtor. Research agents and find one with the knowledge and skills you need will pay off when it's time for you to buy or sell your home. Throughout the process of selling and buying, real estate agents act as mediators between the buyer and seller. Agents have many responsibilities when assisting. Sellers agent. If you engage the services of a listing broker to sell your property, you become the broker's client. That broker represents you, the seller. A Listing is when you create a written agreement with a real estate agent to represent you in the sale of your home. A buyer agent or buyer broker (sometimes called a buyer agency or a buyer's agent) represents the buyer in a real estate transaction. Commission is usually evenly split between the seller's agent and the buyer's agent – typically % to the seller's agent and % to the buyer's agent. The term “agency” is used in real estate to help determine what legal responsibilities your real estate professional owes to you and other parties in the.

Byddy Stock Price Target

Given the current short-term trend, the stock is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. Real time BYD Company (BYDDY) stock price quote, stock graph, news & analysis. Only one analyst offered a short-term price target of $ for Byd Co., Ltd. This represents an increase of % from the last closing price of $ BYDDY's current price target is $ Learn why top analysts are making this stock forecast for BYD at MarketBeat. BYD Co Ltd ADR's average analyst rating is not available. Stock Target Advisor's own stock analysis of BYD Co Ltd ADR is Slightly Bullish, which is based on 4. See the latest BYD Co Ltd ADR stock price (BYDDY Its products primarily target the growing midpriced mass-market segment in China's passenger vehicle market. Analyst Price Targets ; Low ; Average ; Current ; High. Find the latest BYD Co Ltd ADR (BYDDY) stock forecast, month price target, predictions and analyst recommendations. BYD Company Stock Smart Score ; Analyst Consensus. Moderate Buy. Average Price Target: $ (% Downside) ; Blogger Sentiment. Bullish. BYDDY Sentiment 83%. Given the current short-term trend, the stock is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. Real time BYD Company (BYDDY) stock price quote, stock graph, news & analysis. Only one analyst offered a short-term price target of $ for Byd Co., Ltd. This represents an increase of % from the last closing price of $ BYDDY's current price target is $ Learn why top analysts are making this stock forecast for BYD at MarketBeat. BYD Co Ltd ADR's average analyst rating is not available. Stock Target Advisor's own stock analysis of BYD Co Ltd ADR is Slightly Bullish, which is based on 4. See the latest BYD Co Ltd ADR stock price (BYDDY Its products primarily target the growing midpriced mass-market segment in China's passenger vehicle market. Analyst Price Targets ; Low ; Average ; Current ; High. Find the latest BYD Co Ltd ADR (BYDDY) stock forecast, month price target, predictions and analyst recommendations. BYD Company Stock Smart Score ; Analyst Consensus. Moderate Buy. Average Price Target: $ (% Downside) ; Blogger Sentiment. Bullish. BYDDY Sentiment 83%.

The average price target is $ with a high forecast of $ and a low forecast of $

BYDDY Stock Predictions. The 1 analysts offering month price target forecasts for BYD Company have a median target of , a high estimate of The average one-year price target for BYD Company Limited - Depositary Receipt (Common Stock) is $ The forecasts range from a low of $ to a high of. What Is the BYD ADR (BYDDY) Stock Price Today? The BYD ADR stock price today is ; What Stock Exchange Does BYD ADR Trade On? BYD ADR is listed and trades. Get Wall Street analysts ratings for BYD Company Limited (BYDDY). Buy or Sell this stock? See what the analysts say. BYD Co. Ltd. ADR analyst ratings, historical stock prices, earnings estimates & actuals. BYDDY updated stock price target summary. The immediate target for BYD's stock is the $ price level. Reaching this level will confirm the strength of the current trend and open up possibilities. View Byd Co, Ltd BYDDY investment & stock information. Get the latest Byd Co, Ltd BYDDY detailed stock quotes, stock data, Real-Time ECN, charts. According to analysts, price target is CNY with a max estimate of CNY and a min estimate of CNY. Check if this forecast comes true. Exchange. Other OTC ; Today's High/Low. $/$ ; Share Volume. , ; Previous Close. $ ; Annualized Dividend. $ According to 10 Wall Street analysts that have issued a 1 year BYD price target, the average BYD price target is $, with the highest BYD stock price. The average one-year price target for BYD Company Limited - Depositary Receipt (Common Stock) is $ The forecasts range from a low of $ to a high. BYD Co., Ltd. (BYDDY) stock forecast and price target · BYDDYBYD Company Limited. (%). At close: PM · Recommendation Rating. 1. BYD has a consensus price target of $ Q. What is the current price for BYD (BYDDY)?. A. The stock price for. Based on analysts offering 12 month price targets for BYDDY in the last 3 months. The average price target Analysts evaluate the stock's expected. Based on our forecasts, a long-term increase is expected, the "BYDDY" stock price prognosis for is USD. With a 5-year investment, the revenue. Is BYD Stock Undervalued? The current BYD [BYDDY] share price is $ The Score for BYDDY is 65, which is 30% above its historic median score of Buy BYDDY Stock. Buy/Sell BYD Co Ltd over-the-counter (OTC) with Public. Discuss BYDDY news and analysts' price predictions with the investor. Buy BYDDY Stock. Buy/Sell BYD Co Ltd over-the-counter (OTC) with Public. Discuss BYDDY news and analysts' price predictions with the investor. Stock BYDDY BYD COMPANY LIMITED. PDF Report. Consensus BYD Company Limited OTC Markets. Equities. BYDDY. USL Market Closed - OTC Markets. Other stock. View Boyd Gaming Corporation BYD stock quote prices, financial information, real-time forecasts, and company news from CNN.

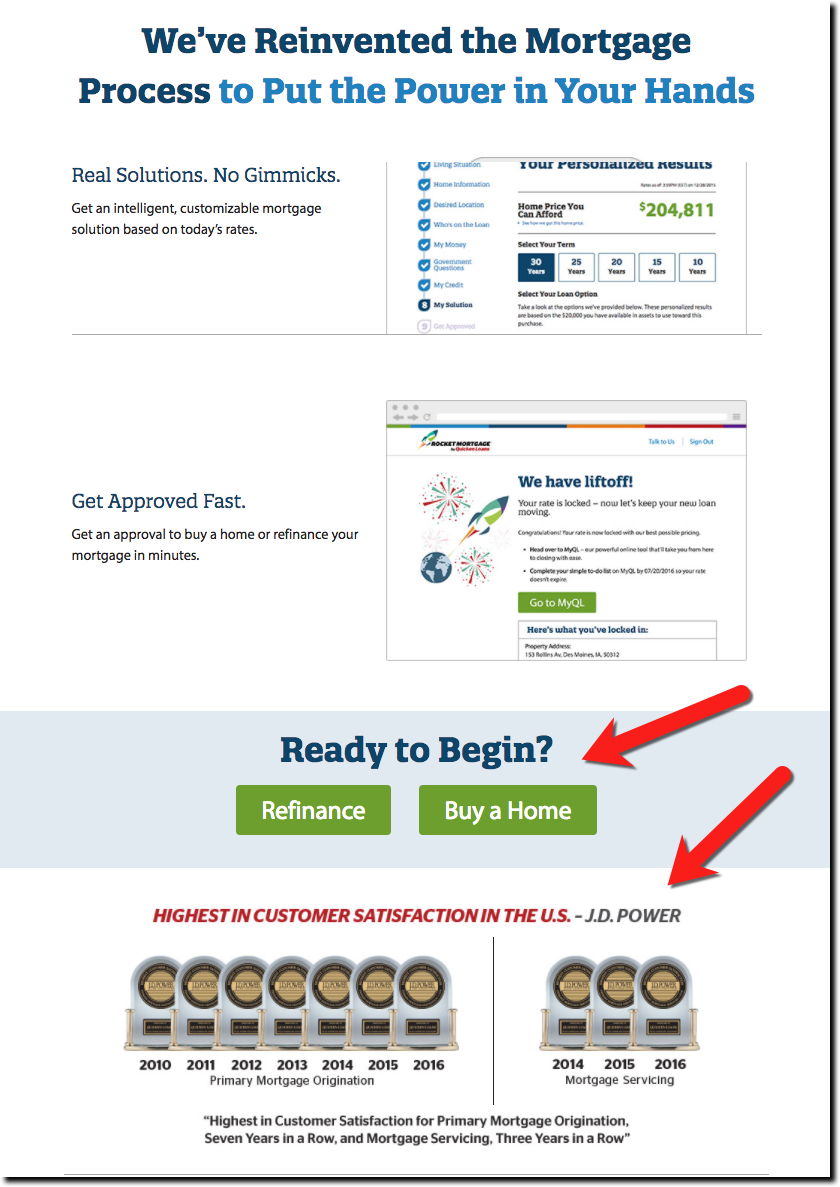

How Good Is Rocket Mortgage

BBB accredited since 2/20/ Mortgage Broker in Detroit, MI. See BBB rating, reviews, complaints, & more. Rocket Loans offers a fast application process and same-day funding for personal loans, but the interest rates and fees are higher than competitors. Rocket. Rocket Mortgage earns our highest affordability rating because of its large variety of loan products. Rocket Mortgage affordability score: 5 out of 5 stars. Home equity loans can be a good way to help qualified borrowers achieve their financial goals, both related to their home and the rest of their financial. Rocket Mortgage received the highest score in the J.D. Power – (tied in ), and Mortgage Origination Satisfaction Studies of customers'. Yes, ONE+ by Rocket Mortgage is a legitimate program allowing qualified homebuyers to put as little as 1% down when purchasing a house. What bank is behind. Rocket Mortgage is the largest mortgage lender in the nation. The lender is also the originator of the digital home lending experience. This article compares Rocket Mortgage vs. Better Mortgage and breaks down each of their products for your review. Rocket Mortgage review: No lender fees, 24/7 support and more · Credit score. Borrowers should have a credit score above these thresholds before applying. BBB accredited since 2/20/ Mortgage Broker in Detroit, MI. See BBB rating, reviews, complaints, & more. Rocket Loans offers a fast application process and same-day funding for personal loans, but the interest rates and fees are higher than competitors. Rocket. Rocket Mortgage earns our highest affordability rating because of its large variety of loan products. Rocket Mortgage affordability score: 5 out of 5 stars. Home equity loans can be a good way to help qualified borrowers achieve their financial goals, both related to their home and the rest of their financial. Rocket Mortgage received the highest score in the J.D. Power – (tied in ), and Mortgage Origination Satisfaction Studies of customers'. Yes, ONE+ by Rocket Mortgage is a legitimate program allowing qualified homebuyers to put as little as 1% down when purchasing a house. What bank is behind. Rocket Mortgage is the largest mortgage lender in the nation. The lender is also the originator of the digital home lending experience. This article compares Rocket Mortgage vs. Better Mortgage and breaks down each of their products for your review. Rocket Mortgage review: No lender fees, 24/7 support and more · Credit score. Borrowers should have a credit score above these thresholds before applying.

Rocket Mortgage review: No lender fees, 24/7 support and more · Credit score. Borrowers should have a credit score above these thresholds before applying. Rocket Mortgage has been awarded the top mortgage origination for 10 years running. It won first place for mortgage services for the past 6 years. Rocket. See if a Rocket personal loan could be right for you by reading ratings and reviews from customers and our editors. Qualifying for a mortgage on reservation land not only deals with your personal financial qualifications, but how your land is held. Lenders like Rocket. It has an overall good rating on our site — stars as of publishing — plus one of the highest customer satisfaction scores in the industry, according to J.D. Rocket Loans has 5 stars! Check out what people have written so far, and share your own experience. Ratings distribution Mortgage Loan Officer employees have rated Rocket Companies with out of 5 stars, based on company reviews on Glassdoor. This. They are great marketers but horrible lenders. Their rates arent that good and they hire the least experienced loan officers. Also because they. Rocket Mortgage is one of America's largest mortgage lenders, offering an extensive array of products. They have continuously added to their digital platforms. Rocket Mortgage is one of the most popular mortgage companies in the US. That's probably because it has stellar customer service reviews and a whole host of. A good way to do that is to use a calculator. We have two that show you Rocket Loans®) are separate operating subsidiaries of Rocket Companies, Inc. Do you agree with Rocket Mortgage's 4-star rating? Check out what people have written so far, and share your own experience. 24 reviews of ROCKET MORTGAGE "This company has false advertisement, they claim they can help you purchase a home and they lie, they don't call you back. Rocket Mortgage works to do the right thing for clients and for its people. Business isn't easy and things aren't always perfect but over 10 years I have so. Learn how the Rocket Mortgage process works and get approved online to buy a home or refinance your mortgage. Dealing with your mortgage doesn't end when you close the loan. Learn what a mortgage servicer is and why a good one is crucial. Rocket Mortgage fees. There is no charge to submit an application for a Rocket Mortgage, however the loan itself involves costs and fees. While the closing cost. Is Rocket Loans legit? Rocket Loans is a legitimate option for fixed-rate, unsecured personal loans. You can pre-qualify without any effect on your credit score. Home equity loans can be a good way to help qualified borrowers achieve their financial goals, both related to their home and the rest of their financial. Learn how the Rocket Mortgage process works and get approved online to buy a home or refinance your mortgage.

The Money Press Method Book

There's always so much talk about options being scary, but after diving into the Money Press strategy, Monica now feels safer trading options over stocks! #. Kindle Download Free The Money Press Method: How To Generate Consistent Income Using Weekly Options No Matter What the Market Does. The Money Press Method. How to Generate Consistent Income Using Weekly Options No Matter What the Market Does. New Books · mandar. Philosophical Reflections on Śabad (Word):Event – Resonance – Revelation · By Arvind-Pal S. · Van Buren. An Introduction to the Metaphysical. The Money Press Method. How to Generate Consistent Income Using Weekly Options No Matter What the Market Does. scribed in his book, New Strategy of Daily Stock Market Timing. very bright, but the financial press as a whole has a poor record of market timing. Discover the entire strategy and the trading tactics yourself in our best selling book “The Money Press Method” today. Get Your Free Copy. The book Money, Morals, and Manners: The Culture of the French and the American Upper-Middle Class, Michele Lamont is published by University of Chicago. Preston James is the author of The Money Press Method ( avg rating, 7 ratings, 3 reviews), The New Gutenberg Press ( avg rating, 0 ratings, 0 revi. There's always so much talk about options being scary, but after diving into the Money Press strategy, Monica now feels safer trading options over stocks! #. Kindle Download Free The Money Press Method: How To Generate Consistent Income Using Weekly Options No Matter What the Market Does. The Money Press Method. How to Generate Consistent Income Using Weekly Options No Matter What the Market Does. New Books · mandar. Philosophical Reflections on Śabad (Word):Event – Resonance – Revelation · By Arvind-Pal S. · Van Buren. An Introduction to the Metaphysical. The Money Press Method. How to Generate Consistent Income Using Weekly Options No Matter What the Market Does. scribed in his book, New Strategy of Daily Stock Market Timing. very bright, but the financial press as a whole has a poor record of market timing. Discover the entire strategy and the trading tactics yourself in our best selling book “The Money Press Method” today. Get Your Free Copy. The book Money, Morals, and Manners: The Culture of the French and the American Upper-Middle Class, Michele Lamont is published by University of Chicago. Preston James is the author of The Money Press Method ( avg rating, 7 ratings, 3 reviews), The New Gutenberg Press ( avg rating, 0 ratings, 0 revi.

The price, dividend, and earnings series are from the same sources as described in Chapter 26 of my earlier book (Market Volatility [Cambridge, MA: MIT Press. scribed in his book, New Strategy of Daily Stock Market Timing. very bright, but the financial press as a whole has a poor record of market timing. The Money Press Method is a great guide to get you started learning new options trading strategies. Preston's WOW program has changed my life. He is the real. The Money Press Method: How To Generate Consistent Income Using Weekly Options No Matter What the Market Does · Book overview. The Money Press Method is a program that teaches you how to make money online by trading options. INSTANT digital access to the Money Press Method before your book arrives (quick download is just minutes away!) · PLUS! 2 BONUS quick-start Training videos. Watch Me Break It All Down From The "Portfolio Margin Secrets" Webinar · New From The Masterminds Behind "The Money Press Method" · This Might Be For You IF. Money Method and Mindset: A simplified approach to trading stocks By Bharat Jhunjhunwala. About this book · Get Textbooks on Google Play. This book gets to the bottom of the twenty-first-century city, literally. Underground moves beneath Romania's capital, Bucharest, to examine how the demand. your money through all market conditions. Click here to join the free investing newsletter. Featured On: Investment Strategy Press. Social Media: Twitter. Music books based on Berklee College of Music methods and curriculum. · Berklee Guitar Chords · Complete Guide to Film Scoring (3rd Ed.):The Art and Business. Professional Training and Coaching. Sandy, Utah 68 followers. Get a FREE copy of my best-selling "Money Press" method tutorial bundle! Click the 'Learn More. This money-saving value pack includes Volume 1 of this practical, comprehensive method book (the basic text for the guitar program at the world-famous Berklee. The price, dividend, and earnings series are from the same sources as described in Chapter 26 of my earlier book (Market Volatility [Cambridge, MA: MIT Press. your money through all market conditions. Click here to join the free investing newsletter. Featured On: Investment Strategy Press. Social Media: Twitter. Using a simulated trading environment with real time pricing and volume, traders have the opportunity to virtually trade a strategy. Press · Investor. The iron butterfly options strategy consists of selling an at-the-money Press · Team · Legal · Help · Contact · Status. © Option Alpha. All Rights. Members receive 3 recent PM e-Books via email at the beginning of the month plus a 50% discount on all purchases from our website. For more about our e-Book. the Money Press Method as I have done a lot of different programs. Discover the entire strategy and the trading tactics yourself in our best selling book “The. Money Method and Mindset: A simplified approach to trading stocks By Bharat Jhunjhunwala. About this book · Get Textbooks on Google Play.

Best Global Technology Funds

On the other hand, Fidelity Global Technology and Herald Worldwide Technology are actively managed funds that have successfully managed to pick technology. The Strategy aims to achieve long-term capital appreciation through investing in a globally-diversified portfolio of technology companies. Find overview, fund performance, and portfolio details on the Columbia Seligman Global Technology Fund from one of the nation's largest asset managers. 1. Exposure to U.S. electronics, computer software and hardware, and informational technology companies · 2. Targeted access to domestic technology stocks · 3. Here are the best Technology funds · The Technology Select Sector SPDR® ETF · Fidelity MSCI Information Tech ETF · SPDR® S&P Software & Services ETF · First Trust. BlueBox continues to fulfil our vision of offering our clients the best long-term thematic investment funds. BlueBox Global Technology Fund. The Direct. This fund scores Above Average because it delivered returns that were in the top % when compared to other funds within its Morningstar category. Columbia. Technology Sector Equity Funds and ETFs are mutual funds that focus on a basket of technology sector stocks. The tech sector features companies in various. Best Technology Funds · #1. Fidelity Advisor® Semiconductors Fund FELAX · #2. Fidelity® Select Technology Portfolio FSPTX · #3. Fidelity® Select Software & IT Svcs. On the other hand, Fidelity Global Technology and Herald Worldwide Technology are actively managed funds that have successfully managed to pick technology. The Strategy aims to achieve long-term capital appreciation through investing in a globally-diversified portfolio of technology companies. Find overview, fund performance, and portfolio details on the Columbia Seligman Global Technology Fund from one of the nation's largest asset managers. 1. Exposure to U.S. electronics, computer software and hardware, and informational technology companies · 2. Targeted access to domestic technology stocks · 3. Here are the best Technology funds · The Technology Select Sector SPDR® ETF · Fidelity MSCI Information Tech ETF · SPDR® S&P Software & Services ETF · First Trust. BlueBox continues to fulfil our vision of offering our clients the best long-term thematic investment funds. BlueBox Global Technology Fund. The Direct. This fund scores Above Average because it delivered returns that were in the top % when compared to other funds within its Morningstar category. Columbia. Technology Sector Equity Funds and ETFs are mutual funds that focus on a basket of technology sector stocks. The tech sector features companies in various. Best Technology Funds · #1. Fidelity Advisor® Semiconductors Fund FELAX · #2. Fidelity® Select Technology Portfolio FSPTX · #3. Fidelity® Select Software & IT Svcs.

The Global X US Tech Top 20 ETF plays a core role in the portfolio since the ETF invests in representative stocks. FUND DETAILS As of 9/4/ Key Facts. Franklin Shariah Technology Fund ; MANUFACTURING ; ADVANCED MICRO ; Fund. MICROSOFT CORP, %. NVIDIA CORP, %. APPLE INC, %. BROADCOM INC, %. The Fund is managed by Harvard Business School graduate and Wellington Global Industry Analyst, Yash Patodia. He has been covering the technology sector for. The Global Technology Fund is lead managed by Storm Uru since February and supported by Clare Pleydell-Bouverie and James O'Connor as fund managers. For the investor seeking aggressive long-term capital growth potential who can accept above-average price fluctuations. This fund should not represent an. In this article, we'll discuss seven top tech ETFs that are worth a look at for investors who may want to add diversified tech exposure to their portfolios. The Fund aims to achieve long-term capital appreciation through investing in a globally-diversified portfolio of technology companies. Equity - Technology · 1 of Active Fund. BIT Global Crypto Leaders I-I · Jan Beckers · Ha Duong. USD, %, , % · 2 of Passive ETF. Amundi MSCI. globally. APPLY FOR SUPPORT. Internet Freedom Fund. This fund supports innovative internet freedom projects, including technology development, research. All securities in the index are classified in the Information Technology sector as per the Global Industry Classification Standard (GICS®). Lipper Science &. Putnam Global Technology Fund ; Top Equity Issuers. As of 07/31/ Updated Monthly ; Seagate Technology ; Fund. Microsoft, %. NVIDIA, %. Apple, Top Issuers by AUM ; Invesco, , 9 ; Amplify Investments, , 6 ; Mirae Asset Global Investments Co., Ltd. , 7 ; WisdomTree, , 3. This global growth fund invests in companies that create and benefit from advances in technology. We invest in companies we believe to be resilient. An actively managed, global, all-cap fund that seeks to invest in companies that can benefit from innovation in technology. The World Technology Fund seeks to maximise total return. The Fund invests globally at least 70% of its total assets in the equity securities of companies. Top 10 Holdings ; NVIDIA Corp. NVDA, % ; Apple Inc. AAPL, % ; Microsoft Corp. MSFT, % ; Taiwan Semiconductor Manufacturing Co. Ltd. TSMWF, %. Top Holdings As of 09/06/24 ; , IBM, IBM ; , NOW, SERVICENOW INC ; , BABA, ALIBABA GRP-ADR ; , CSCO, CISCO SYSTEMS INC. Best Technology Funds · #1. Fidelity Advisor® Semiconductors Fund FELAX · #2. Fidelity® Select Technology Portfolio FSPTX · #3. Fidelity® Select Software & IT Svcs. Fidelity Select Semiconductors Portfolio (FSELX) · Columbia Seligman Global Technology Fund (CGTYX) · Columbia Seligman Technology and Information Fund (SCMIX). Technology private equity firms typically raise capital from institutional investors such as pension funds Warburg Pincus, the global private equity.